The Difference Between Economic and Non-Economic Damages

Key Takeaways

- Economic damages reflect real, verifiable losses such as medical bills and lost income.

- Non-economic damages address intangible harms, such as pain, anguish, and loss of enjoyment of life.

- Understanding both is crucial, as each requires different forms of evidence and calculation methods.

Table of Contents

- Introduction

- Economic Damages

- Non-Economic Damages

- Calculating Damages

- Proving Damages

- Legal Considerations

- Conclusion

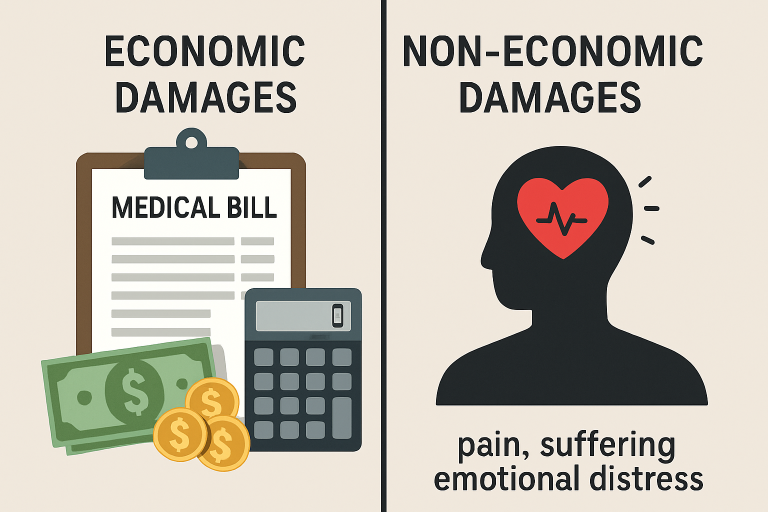

Understanding the distinction between economic and non-economic damages is essential for anyone considering a personal injury claim. When a person suffers harm due to someone else’s negligence, the law provides for two primary types of compensation to address the full scope of their losses. These are categorized as economic damages—tangible, out-of-pocket losses—and non-economic damages, which cover more subjective aspects such as pain and emotional suffering. Suppose you’re navigating a complex injury case. In that case, consulting with experienced professionals like those at Blakefriedmanlaw.com can make a significant difference in how your claim is handled and your chance of full recovery. Understanding economic and non-economic damages is crucial for a successful claim. Economic damages cover measurable losses, while non-economic damages cover non-monetary suffering. Understanding both types helps advocate for fair compensation.

Economic Damages

Economic damages, frequently known as special damages, form the cornerstone of personal injury compensation. These are the financial costs that directly result from the injury—costs that can often be substantiated with documentation. Key types of economic damages include:

- Medical Expenses: Hospitalizations, surgeries, medications, ongoing therapies, and even future anticipated medical costs.

- Lost Wages: Any loss of income due to missed work, including potential future earning capacity if the injury leads to long-term disability.

- Property Damage: Repair or replacement costs for vehicles, electronics, or other personal property affected by the incident.

- Out-of-Pocket Costs: Practical expenses, such as travel to medical appointments or necessary home adaptations due to disability.

The guiding principle behind economic damages is to make the injured party whole again, at least financially. Careful recordkeeping and comprehensive documentation are critical, as insurers and courts alike rely on this evidence to verify each claim. For more on establishing the cost of injury-related losses, see this overview on FindLaw.

Non-Economic Damages

Non-economic damages, often referred to as general damages, encompass the subjective impact an injury has on an individual. Unlike economic damages, these losses don’t typically appear in financial statements, yet can profoundly affect an individual’s life. Typical non-economic damages include:

- Pain and Suffering: Chronic physical pain and discomfort resulting from the injuries.

- Emotional Distress: Mental health challenges like anxiety, depression, or post-traumatic stress disorder (PTSD) following an accident.

- Loss of Enjoyment of Life: If the injury curtails hobbies, activities, or day-to-day pleasures.

- Loss of Consortium: The diminished relationships between the injured person and their spouse or close family.

Since these damages are inherently subjective, establishing the extent of harm often involves personal testimony, statements from family and friends, and expert assessment from psychologists or other medical professionals.

Calculating Damages

Accurately determining damages is vital in reaching a fair settlement or court award. For economic damages, the calculation depends on compiling all relevant receipts, bills, pay stubs, and objective evidence. Future costs are sometimes included, particularly if long-term care or lost earning potential is expected.

Methods for Valuing Non-Economic Damages

Non-economic damages present a bigger challenge, as there’s no universal standard. Common methods include:

- Multiplier Method: The total economic damages are multiplied by a factor (often between 1.5 and 5), which reflects the severity and long-term impact of the injury.

- Per Diem Method: Assigning a daily dollar value to pain and suffering, then multiplying by the number of days the victim is impacted.

The involvement of expert testimony and supporting evidence strengthens the credibility of non-economic damage calculations.

Proving Damages

Demonstrating economic damages is primarily a matter of gathering documentation, including medical bills, pay stubs, invoices, and receipts, all of which play critical roles. Statements from your employer or medical professionals can further substantiate your claim. With non-economic damages, proving the extent of harm relies heavily on narrative evidence. Personal accounts, supported by friends, relatives, and mental health experts, are crucial in illustrating the day-to-day impact and ongoing emotional hardship.

Legal Considerations

The rules governing damage awards vary significantly from state to state. Many jurisdictions impose “caps” on non-economic damages, particularly in medical malpractice or certain types of tort claims. These caps, which commonly range from $250,000 to $750,000, are intended to mitigate huge awards but can limit recovery in severe cases. Being informed about local regulations and limits is essential, and legal counsel with experience in your state can be vital to protecting your interests.

Conclusion

Distinguishing between economic and non-economic damages is vital for a just personal injury recovery. While economic damages repair your measurable financial setbacks, non-economic damages seek to address the profound but less tangible impacts on your well-being. Properly preparing for both categories maximizes your chances of achieving fair compensation and moving forward with your life after an injury.